Introduction

Ecommerce transactions have been on the rise for years, but when you look at the number of digital transactions in 2020, it’s clear the COVID-19 pandemic has significantly accelerated ecommerce growth.

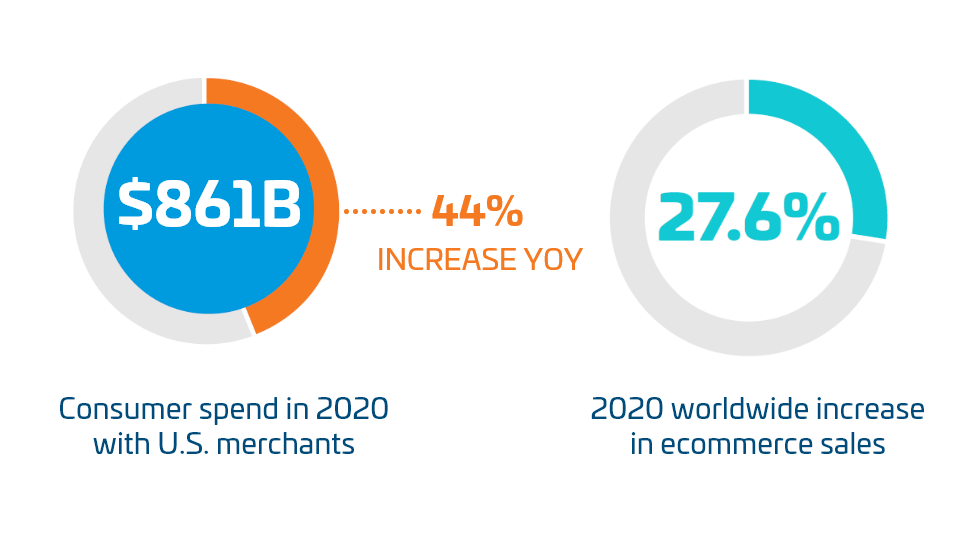

According to Digital Commerce 360, in 2020 consumers spent $861.12 billion online with U.S. merchants alone, which is an increase of 44% year-over-year and is triple the 15.1% growth we saw in 2019.

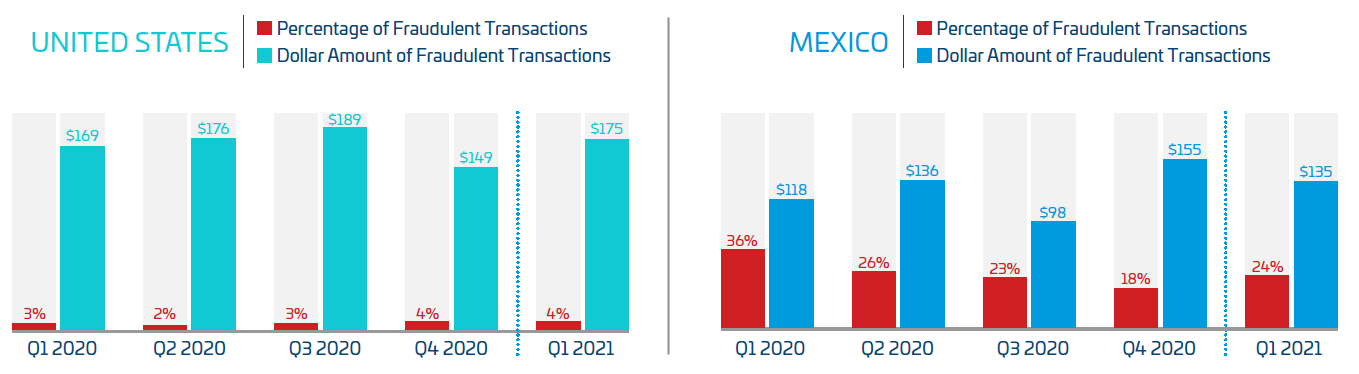

While consumers’ affinity for online shopping is good news for ecommerce merchants, there’s a looming threat that many are unprepared to handle, and that’s card-not-present (CNP) fraud.

.png)

.png)

%20(1).png)