Accurate transaction decisions in real time

5-15% of revenue is lost to manual fraud management

annually across the globe

"With Vesta we are able to improve our success rate for payment, increase customer satisfaction, and enhance our revenue. Vesta allows us to focus on the business rather than trying to catch the fraudsters ourselves."

President of Commerce and Fintech, Bukalapak

![]()

.png)

Vesta clients see an average 10% increase

in their transaction approval rates

Fraud is not static—your approach shouldn't be either

Fraud has become very sophisticated —it requires more than one rule or one check. You shouldn't try to master it alone, but should lean on experts.

Team with experts that have historical, insider knowledge on fraud—and the tools and technology to eliminate it. That’s where Vesta steps up.

Fully-guaranteed transactions

Vesta is a pioneer in fully-guaranteed transactions. We eliminate your risk and liability from fraudulent chargebacks. In turn, you get unrivaled accuracy and increased approvals of legitimate online sales.

Whether challenged with unwelcomed manual reviews, false declines or customer friction, Payment Guarantee clears the path for legitimate customers to purchase more easily and blocks malicious transactions from fraudsters. We remove the hassle and time commitments associated with managing fraud, allowing you to focus on driving business, not chasing down bad guys.

Benefits of guaranteed payments

Vesta's indemnification solution increases revenue by approving more legitimate orders, and reducing your losses from fraud.

Our customers get an easy-to-use dashboard that helps track which orders have been guaranteed by Vesta, streamlining order review

and giving you time back in your day.

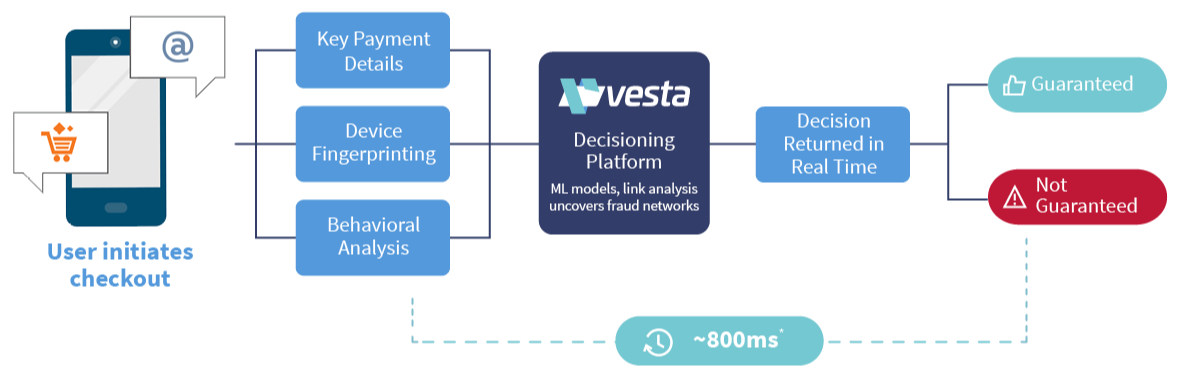

How it works

From the moment a customer selects "Place order" to the final decision, Payment Guarantee is fast, frictionless and accurate.

Key features

Automated workflows, modern capabilities and a global cloud platform make is simple to integrate

into all your digital channels, apps and web systems.

Explore use cases

Beware of over-declining

When trying to prevent fraud, many retailers decline more transactions than needed, leaving money on the table and frustrating good customers.

A good fraud prevention solution should focus as much on approving good transactions as it does preventing fraudulent ones. Vesta uses advanced technology to be able to tell the difference, maximizing your approved orders and revenue.

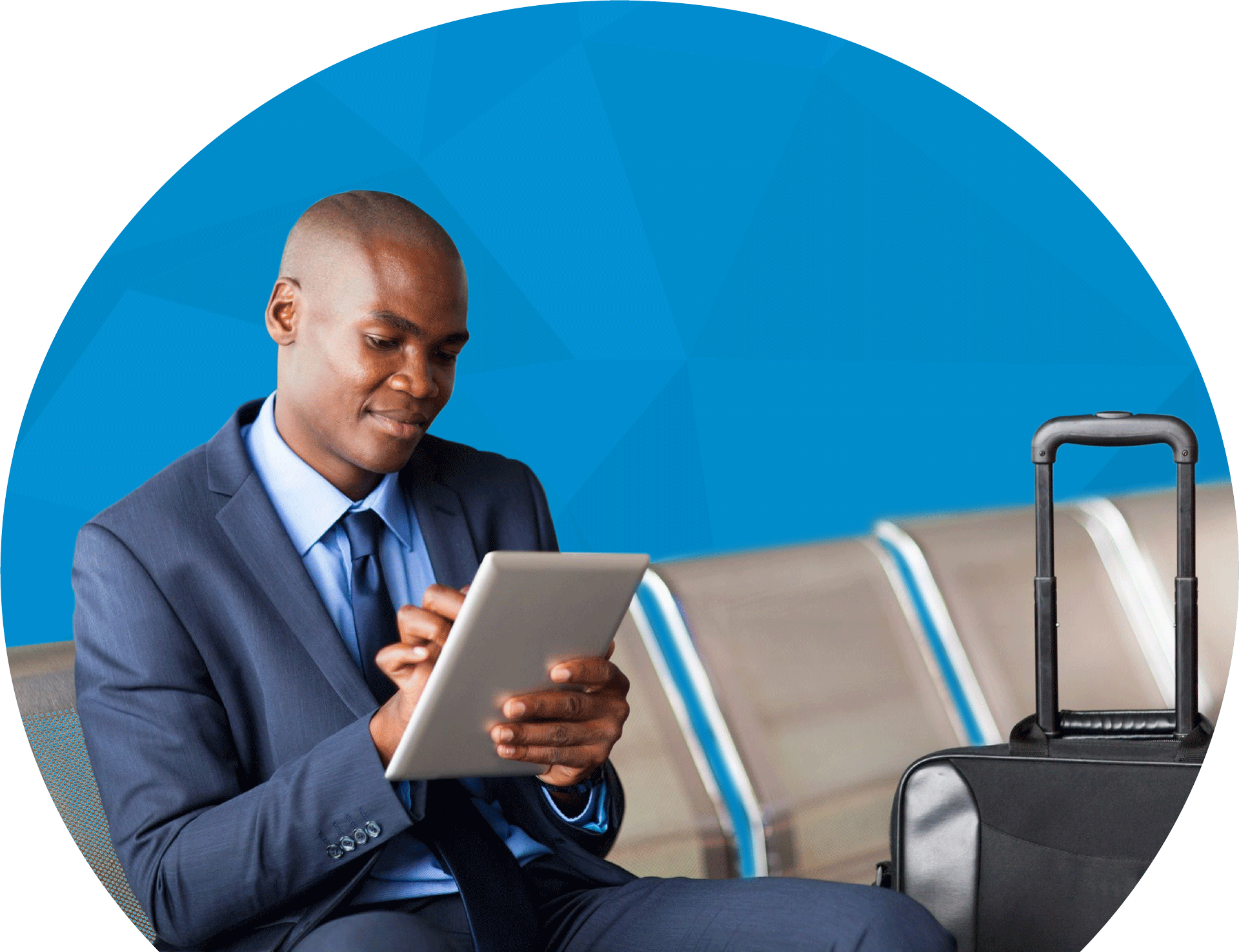

Keep loyal customers coming back

Airlines and hospitality companies rely on stellar customer experiences to keep customers coming back.

Payment Guarantee enables real-time transaction risk assessments to reduce false declines without adding unnecessary friction during checkout for legitimate customers.

Safeguarding international money transfer

Money transfer across borders can be a risky venture, whether in-person, online or over the phone.

Through real-time transaction assessment, Vesta can protect against many fraud entrance points to improve approval rates while reducing fraud rates and bringing chargeback costs to zero.

The true cost of eCommerce fraud

Learn about the factors that play into the true cost of fraud. This ebook looks at the key costs associated with fraud, and how businesses can effectively manage their fraud problem to maximize approval rates and eliminate risk.

Copyright © 2023. All rights reserved.