Risk scores, reasons and detailed insights.

Protect and accelerate revenue with enhanced risk score insights.

.gif?width=600&height=396&name=video-to-gif%20(2).gif)

Use actionable insights to eliminate fraud and safeguard revenue

Arm your in-house team

How can your eCommerce business approve more legitimate transactions—especially when in-house fraud prevention tools tend to use a static, rules-based approach that declines more transactions than necessary?

Don't leave money on the table and good customers out to dry. Payment Protect can work with your in-house solutions to provide more details to make better transaction decisions.

Enhance your decisioning with powerful risk tools

Our risk score solution provides a set of decisioning tools that empower fraud teams to make real-time decisions, making it easy to accept safe transactions and reject fraudulent ones.

Payment Protect is leveraged by fraud teams in need of tools to enhance existing fraud technologies, as well as those looking to outsource day-to-day fraud operations. Our easy-to-use console provides dashboard views that help you identify risky transactions and make informed decisions.

Payment Protect benefits

Protect every transaction

Catch fraud faster with pre-configured rules that are ready to use on day one.

Reduce operational costs

Eliminate the hassle of multiple solutions by managing fraud operations from one dashboard.

Unlock business growth

Save costs by reducing manual reviews and focus on generating revenue.

Use cases for Payment Protect

Features

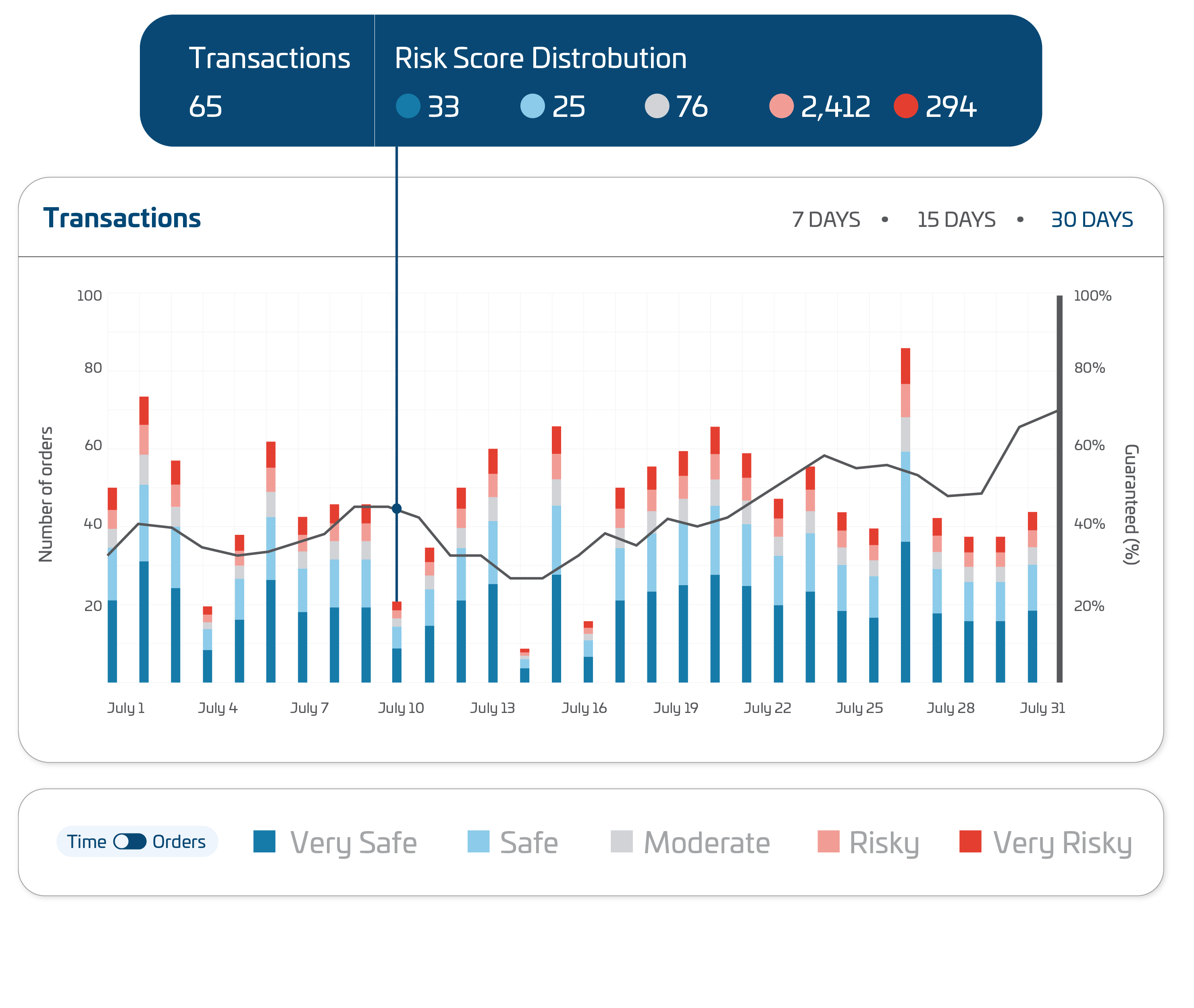

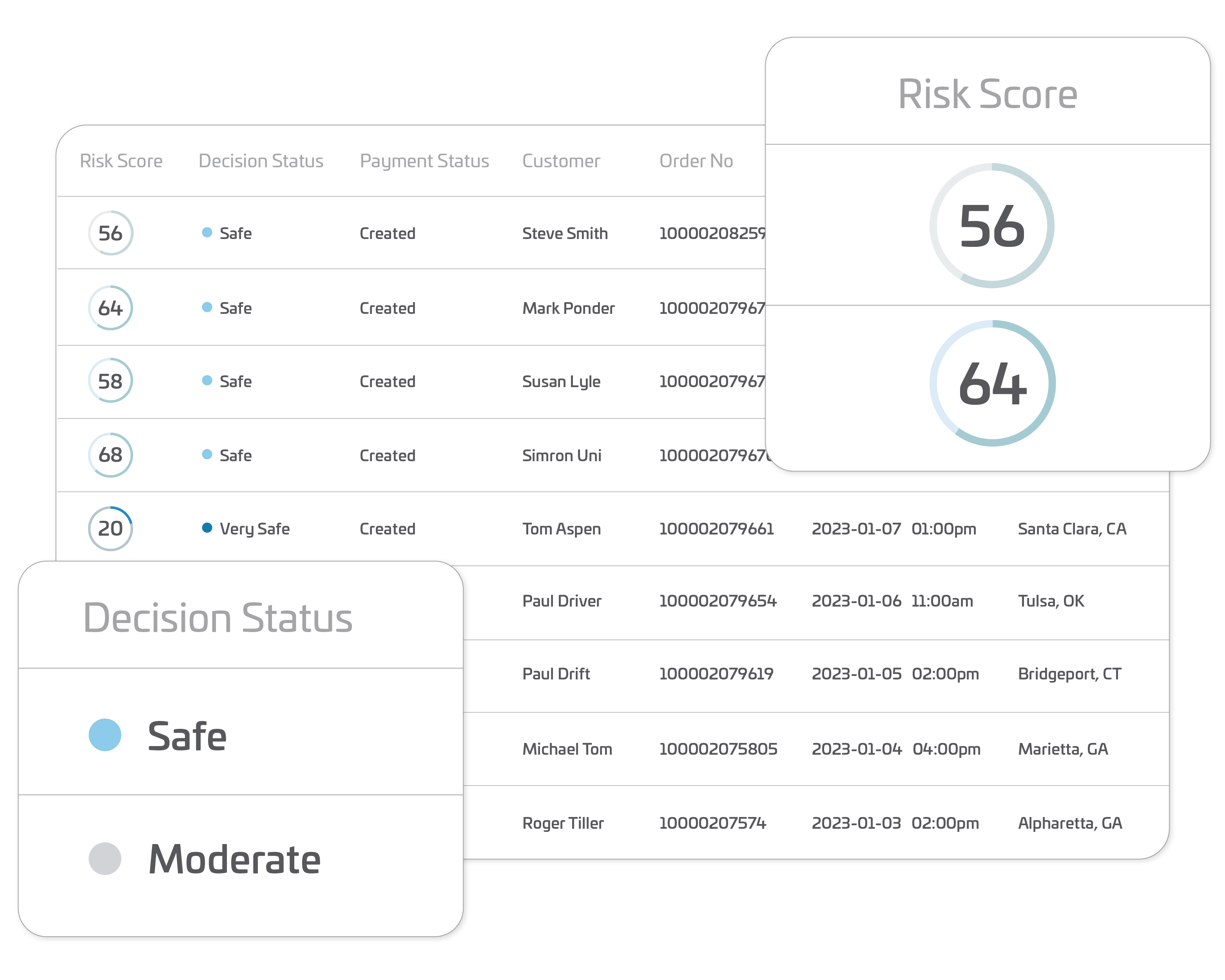

→ Data-driven decisioning

Protect your revenue from fraudsters by leveraging accurate risk scores built by experienced data scientists.

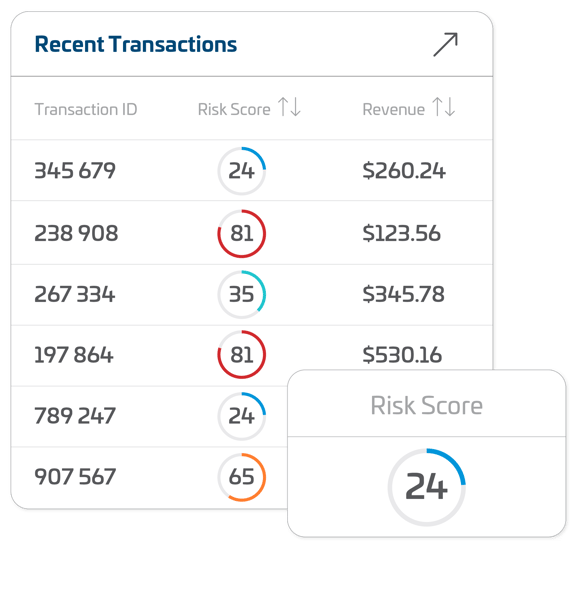

→ Risk-level indicators

See a detailed view of how risky transactions are so that you know immediately whether you are dealing with a very safe order, a very risky order, or something in between.

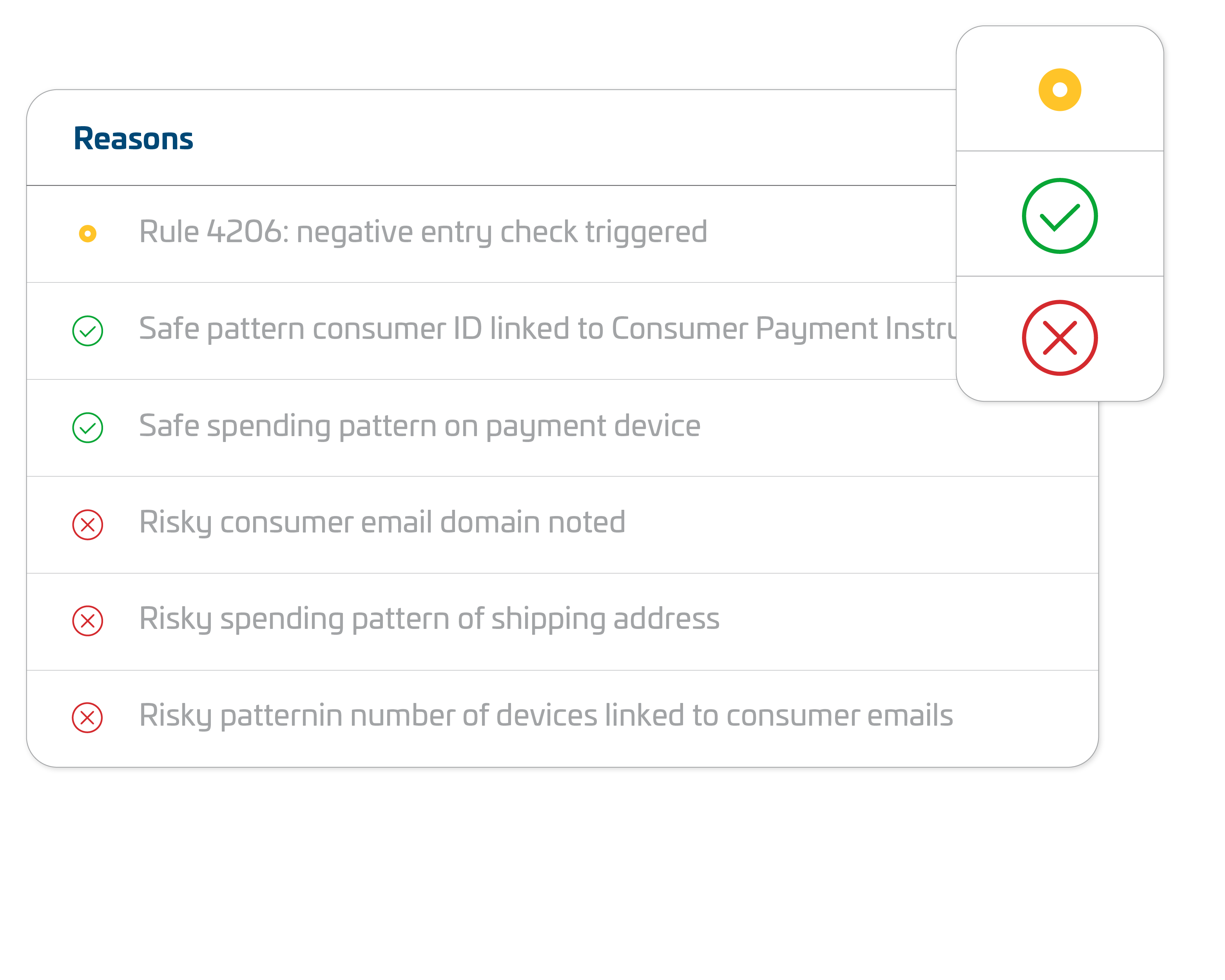

→ In-depth risk score reasons

Optimize decisions with risk score explanations that provide reasons behind a score, enabling you to make more informed decisions.

→ User-friendly analytical tools

Use simple analytical tools that help you find the best risk score threshold for your orders. Drill down into specific segments to make more refined decisions and pull out more approvals.