Fraud prevention that

Chargebacks, false declines and payment fraud negatively impact your business. Vesta can help —guaranteed.

Approve More Transactions

Eliminate Fraud

Increase Revenue

Solutions that deliver smart decisions, higher approval rates

Vesta Payment Protect™

Get accurate payment fraud detection, risk scoring and decision tools to make the best decisions for transactions in real time.

Learn More →

Vesta Payment Guarantee™

With Payment Guarantee, your transactions are 100% guaranteed against fraud.

Learn More →

Advanced Platform Capabilities

Our platform analyzes billions of data points. As a result, you’re able to approve more transactions by taking the guess work out of the equation —no more false declines!

Learn More →

Don’t Leave Money on the Table

Vesta uses a data science model that analyzes trillions of data points to find connections and uncover fraud, keeping your online store safe and secure from bad actors. Helping your eCommerce store approve more legitimate transactions is mission-critical.

How do we do this?

Through machine learning (ML), artificial intelligence (AI) and progressive graph analysis built for fraud prevention.

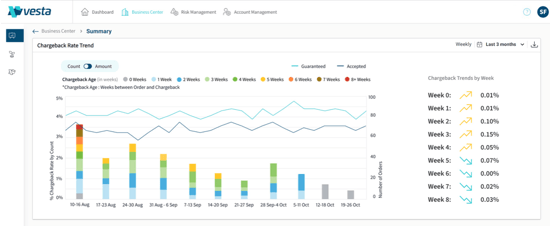

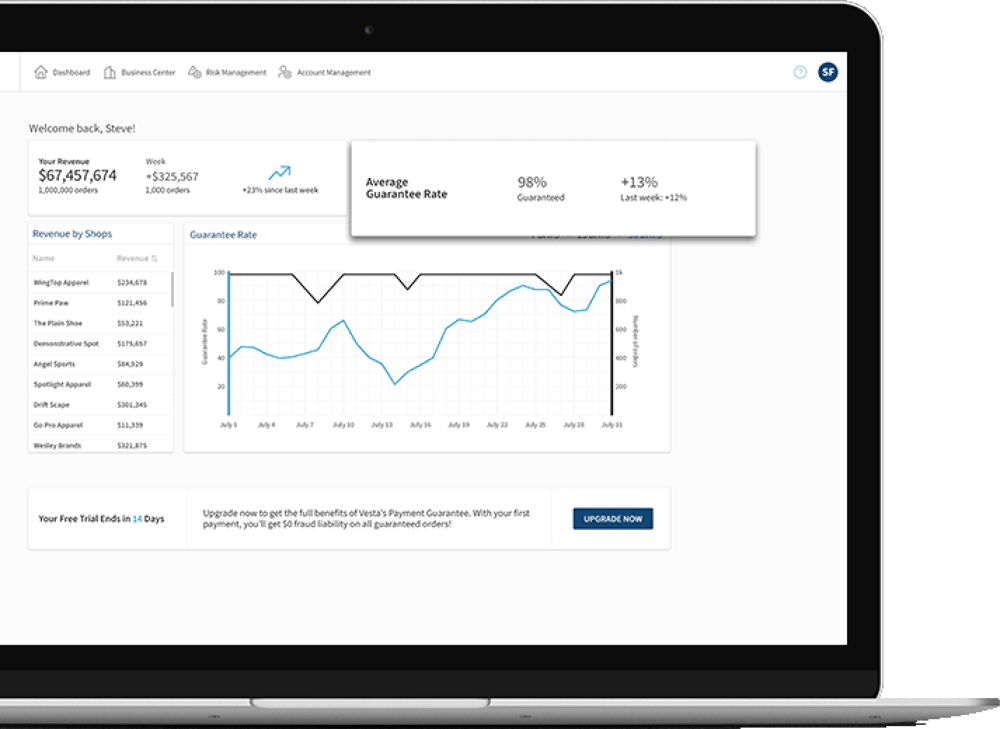

Visual Dashboard at Your Fingertips

Admin users can easily monitor transaction scores and decisions, review risk score reasons, track approval rates, run reports and more.

Approve more transactions

Increase sales

Reduce fraud loss

Improved customer experience at checkout

And with our solution portfolio, you get the power of choice: keep transaction decisioning in-house or let Vesta’s fraud fighters manage it for you. Not sure what’s best for you? Our experts can help.

We Are Fraud Protection Pioneers

Vast Fraud-Fighting Experience

Vesta has been on the front lines of fraud prevention for more than 25 years! That legacy matters when you’re choosing a partner that understands every aspect of fraud protection.

Safest Transactions Technologically Possible

Even the most sophisticated fraudsters don't stand a chance against our advanced AI models to detect anomalies and inconsistencies.

“We have assessed a number of players and realize that Vesta has very strong technology. Vesta is definitely one of the leaders in fraud protection and guaranteed payment.”

VP of Payment Strategy and

Partnerships, Bukalapak

Watch a Free 2-Minute Demo of Our Award-winning Platform

Copyright © 2023. All rights reserved.

Learn More

Learn More

.png?width=366&height=60&name=bukalapak%20(1).png)