Vesta Offers Zero-Fraud Guarantee Solutions That Leverage 3DS Intelligently to Increase Approvals

With online transactions projected to grow 85% in the next five years, it is more important than ever to invest in security. But despite the increase in online transactions, approval rates for digital payments (82%) are still significantly lower than brick and mortar (98%). This has led to a loss of revenue as transactions are rejected and frustrated customers go looking for better options.

The introduction of 3D Secure

3D Secure (which stands for three-domain secure) was developed in 1999 when e-commerce was just taking off, and was later implemented by major credit card companies like Visa and MasterCard in 2001. It was designed to add an extra layer of protection for merchants by requesting additional authentication from the cardholder.

While 3DS1 was a step in the right direction, it came with a set of issues:

Friction at checkout: Buyers had to deal with out-of-context pop-ups or, worse, a redirect to a third-party’s page for authentication.

Cart abandonment: Because who wants to hassle with a complicated checkout flow?

Lack of mobile support: 3DS1 was built for desktops. When buyers started turning to their phones for online shopping, 3DS1 couldn’t keep up.

These roadblocks to revenue and customer experience limited the widespread adoption of 3DS1.

Enhancing fraud management: Vesta’s 3DS2 solution

In 2016, EMVCo (jointly owned by Visa, MasterCard, American Express, JCB International, and China Union Pay) released 3D Secure Version 2. The new version of 3DS introduced significant enhancements to secure customer authentication (SCA) and addressed the customer experience issues of the prior version.

Vesta is uniquely positioned to fine tune the 3DS decision-making process with superior analytics. Leveraging machine learning intelligence and 25 years of data, Vesta offers risk decisioning capabilities that can decide

1) when the 3DS challenge needs to be invoked, and

2) when to fallback to 3DS1.

Our Payment Protect and Payment Guarantee products come with built-in configurations to invoke the right routing decisions for Secure Customer Authentication (SCA) and provide the necessary information to the issuer bank for the frictionless flow option.

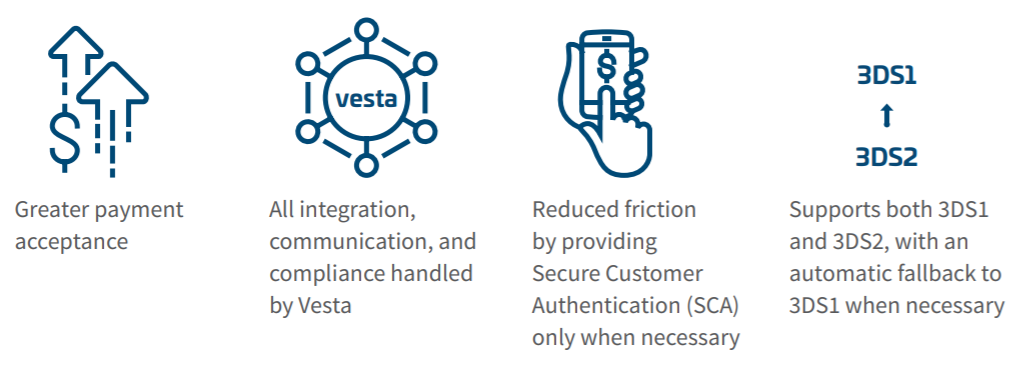

This means as a merchant you can:

Maximize payment acceptance: By shifting liability, you can accept more payments that might otherwise by declined.

Conduct transactions with confidence: Vesta brings turnkey management of 3DS integration and compliance so you can focus on growing your business.

Gain stronger risk-based authentication and frictionless flow: Merchants and banks get 10x the data for better risk assessment. Static passwords are replaced with one-time codes and biometric data. SCA is provided precisely when and where it is needed.

Vesta Corporation is a pioneer in processing fully guaranteed card-not-present (CNP) payment transactions for e-commerce merchants. We offer scalable protection payment solutions and patented fraud protection services. We focus on protecting your revenue from chargebacks and fraud so you can focus on your company’s strategic growth. You can request a demo of our services here.

.png)

.png)

%20(1).png)