Cross-border payment acceptance can expand the reach of your business but also introduce a higher risk of fraud attacks. Similarly, money transfers come with their own risks. In this article, we'll talk about how to protect your customers' payments and/or money remittance globally.

In today's fast-evolving digital landscape, expanding your business globally can open doors to unprecedented growth. With an estimated 2.14 billion global digital shoppers, eCommerce continues to experience a major boom. However, amid this surge in online consumer activity, there has also been a significant uptick in card-not-present (CNP) fraud, posing a substantial threat to businesses worldwide.

- Cross-Border Payment Fraud

Cross-border payment acceptance can extend your business's reach but also exposes it to a heightened risk of fraudulent attacks. The statistics are telling: Global CNP fraud has tripled, surging from $9.84 billion in 2011 to a staggering $32.39 billion in 2020. Projections indicate that by 2027, merchants could incur losses totaling a staggering $40.62 billion due to payments fraud—a daunting 25% increase over 2020. For cross-border eCommerce businesses, the risk is amplified.

The sophisticated nature of cross-border fraud schemes necessitates a robust defense strategy. Let's delve into some key aspects of this growing concern.

- Money Transfers

Money transfers are the lifeblood of international commerce, facilitating transactions across borders. However, they come with their own set of risks, especially when it comes to fraud prevention. Did you know that the average wire fraud loss per case is $8,304? Here are the critical issues to consider:

- Blacklisting Entire Countries or Geographic Regions: While certain regions may be notorious for international fraud, blanket blacklisting can lead to missed sales opportunities. Instead, consider adopting a fraud protection platform with a proven track record of intercepting fraudulent transactions in foreign countries, striking a balance between security and business growth.

- The Perils of Insufficient Fraud Tools: Inadequate fraud detection tools, often free or rudimentary, can result in increased false declines and lost revenue. To combat this, seek a comprehensive platform that harnesses the power of machine learning. Machine learning continuously adapts to emerging fraud trends and identifies anomalies in transaction data with greater precision than rule-based systems.

- How AI and ML Can Transform Fraud Prevention

To fortify your international fraud prevention strategy, your best line of defense is leveraging the power of AI and machine learning models trained on billions of transactions. Payment fraud prevention today is a much bigger task than it was in the past due to technological advances.

Vesta is at the forefront of link analysis--a component of fraud detection and prevention that analyzes billions of data points in real time to return incredibly accurate decisions about whether or not a transaction is fraudulent or not. Read our article to learn more about graph link analysis for fraud prevention.

Consider the following tactics:

- Delving into User Payment Info and Activity: Beyond geographical considerations, scrutinize payment information and user activity. For instance, be vigilant when a previously unused credit card is employed for a substantial international purchase. Such deviations from established patterns can serve as red flags, warranting closer inspection.

- Unlocking the Potential of Artificial Intelligence and Machine Learning (AI/ML): Effectively combating fraud often necessitates the formidable capabilities of artificial intelligence and machine learning. Solutions like Vesta's leverage AI and ML to not only detect fraud but also continually learn from past transaction data, delivering increasingly precise results over time. This adaptive approach is crucial in an environment where fraudsters continually evolve their tactics.

Lean on Vesta's Experience

In the realm of cross-border eCommerce, fraud prevention is not just a priority—it's an imperative. Even a single instance of fraud can inflict significant damage on your business's reputation and finances. Therefore, it's crucial to adopt advanced fraud prevention strategies that leverage cutting-edge technologies like AI and ML.

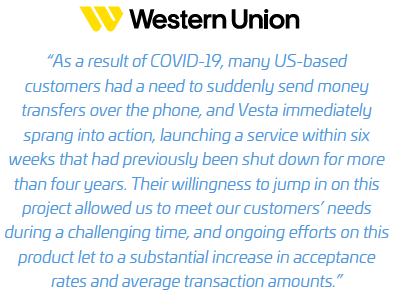

Vesta helped a global leader with a volume of $80+ Billion in cross-border, cross-currency money transfers minimize costs, increase approvals and reduce checkout friction by precisely eliminating payment risk. We helped achieve +60% increased approval rates and brought their cost of fraud to $0.

To explore comprehensive fraud solutions that incorporate AI and ML, explore the resources provided by Vesta. These state-of-the-art technologies are designed to help you detect fraudulent behavior with unmatched accuracy. We're so confident in our Payment Guarantee fraud solution that we'll cover the cost of fraud on any approved transaction that comes through our platform--guaranteed.

In a world where global transactions are the lifeblood of business success, safeguarding your customers' payments and money transfers is no longer a choice—it's a necessity. By integrating AI and ML into your fraud prevention arsenal, you can fortify your business against the ever-present threat of fraud. These technologies adapt and evolve alongside the dynamic landscape of cyber threats, providing your business with a robust defense against this persistent menace.

In closing, remember that the global eCommerce landscape is ripe with opportunities, but it's also teeming with challenges. The proactive adoption of AI and ML-driven fraud prevention measures is not just a smart business move—it's the key to secure and sustained growth in the digital age. Contact us today to discover how AI and ML can be your partners in this ongoing battle against fraud, ensuring your business thrives in a rapidly changing world.

.png)

.png)

%20(1).png)