If we could land just one email in the inbox of eCommerce business owners or their fraud prevention/technology team(s), we'd do our best to raise awareness about one issue more than any other--employing the right fraud prevention strategy. In fact, this article is all about how we'd write that email. Keep reading!

Subject line: Now is the time to move beyond rules-based fraud prevention for eCommerce

Dear Fellow Fraud Fighter,

This email is to address a critical issue that affects every eCommerce business: fraud prevention. In recent years, the number and sophistication of fraud attacks have increased dramatically, posing a significant threat to the financial stability and reputation of eCommerce businesses like yours.

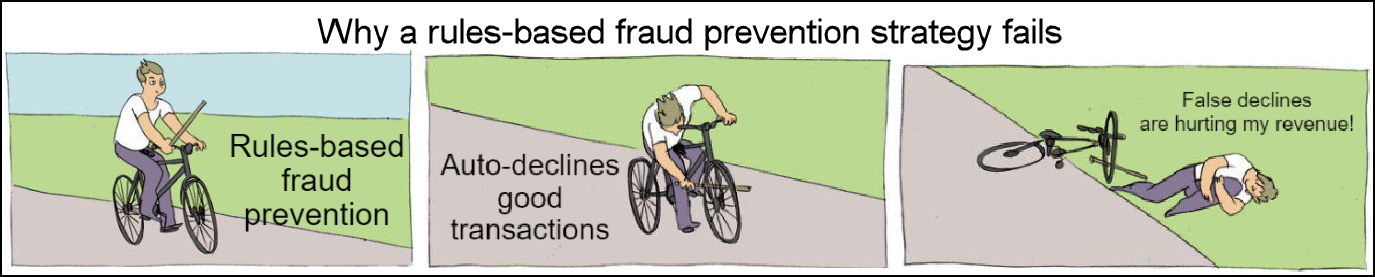

As you may know, rules-based fraud prevention has been one of the traditional approaches to tackling fraud in eCommerce. However, I want to make it clear that rules-based systems are no longer sufficient in the face of the evolving fraud landscape. Here's why. Primarily relying on a rules-based strategy:

- Limits your ability to detect and prevent fraud. It relies on predefined rules to flag potentially fraudulent transactions, but these rules are often rigid and inflexible. They cannot adapt to new fraud schemes or patterns, making them easy to bypass for sophisticated fraudsters.

- Generates a high number of false positives, leading to unnecessary declines of legitimate transactions. This can result in lost revenue, dissatisfied customers, and damage to your business's reputation.

- Requires significant time and resources to set up and maintain. Rules require constant updates and adjustments, which can be costly and time-consuming.

Given these challenges, you need to move beyond rules-based fraud prevention and adopt more advanced and effective solutions. Machine learning and AI-powered fraud prevention systems are emerging as the most promising approach to detecting and preventing fraud in eCommerce. These systems can analyze large amounts of data and identify complex patterns and anomalies that are impossible for rules-based systems to detect.

In conclusion, we urge you to take action to upgrade your fraud prevention system to a more advanced and adaptive solution. You cannot afford to rely on outdated methods that leave you vulnerable to fraud and lost revenue. Let's work together to protect your business and your customers from the everchanging threat of eCommerce fraud.

Best regards,

Your Vesta Fraud Fighting Team

As a fraud prevention specialist at your company, would it help you to have a first draft message to share with your leadership team? Vesta has you covered. Just copy and paste the messaging template below to communicate this important topic to the leadership team at your company. Use it as an email, text, or whatever works best for you!

Hi Team Leader,

I recently came across an article on the topic of fraud prevention and wanted to ask you about an idea I have to increase profitability.

We might actually be able to increase our business’s revenue by using a more robust fraud prevention strategy. If we add machine learning models, including artificial intelligence, we should be able to authorize more transactions while stopping more fraud, which would increase our revenue across the business.

Even more—I’ve found a solution that indemnifies our company against fraudulent chargebacks, meaning we wouldn’t have to pay for them anymore.

How would you feel about me exploring the cost-to-benefit ratio a little further, and then I can show you some of the numbers like costs, savings, and increased revenue projections?

Sincerely,

Want to see the Vesta platform in action? Check it out here.

.png)

.png)

%20(1).png)