A short history and what the future holds.

References to the saying "Set a thief to catch a thief" can be found as far back as 1564. And though it may be a common belief that to catch criminals you must think as they do, credit card issuers have not always followed this advice.

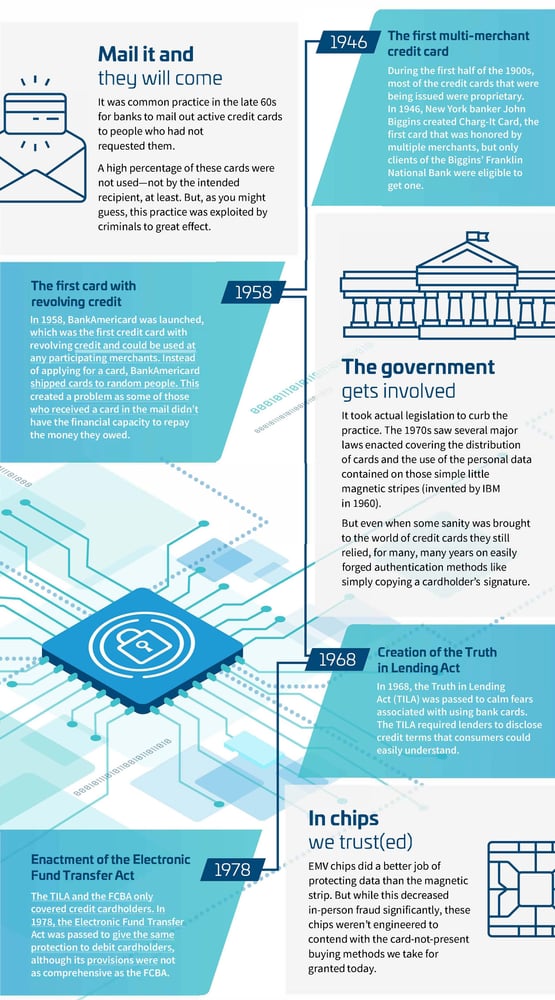

Mail it and they will come

Technology takes the lead

The answer is technology. The benefits of artificial intelligence and machine learning are now impacting the day-to-day life of merchants in very meaningful ways. Machines are better at spotting trends, seeing behavioral patterns and cross-referencing past and present-all at lightning speed.

This ability to analyze thousands of transactions in moments instead of days or weeks has it's obvious advantages over manual, human efforts.

It's also quickly becoming a requisite capability of any fraud prevention system worth its salt, as criminals are also constantly refining their tech in order to perpetrate fraud. Using Al and machine learning together also means you can apply that analysis better and faster than ever before.

Vesta brings AI driven fraud prevention and protection to businesses of any size. Contact our sales professional to learn more.

.png)

.png)

%20(1).png)